New Year, New Financial Start

Confidence in your financial plan is crucial, but what do you do if you don’t

This is where it all begins. In your first month, we will get to know each other. What are your goals, your needs?

We start to dig a little deeper. Let’s clarify those goals and start to make a plan. You’ll give us your data and your statements, and we’ll show you how we geek-out over numbers.

This is the meat. Where stuff gets real. We provide our financial recommendations and plan. We talk strategy to plan for the sprint and for the long-haul, We discuss your investment portfolio and the strategy you’ll use moving forward.

Fueling: a fire keeps blazing with fuel. We want to make sure you stay on the right track and fuel your success. After your Ignite period is over, we will set up recurring meetings to discuss progress, hurdles, and changes to the plan.

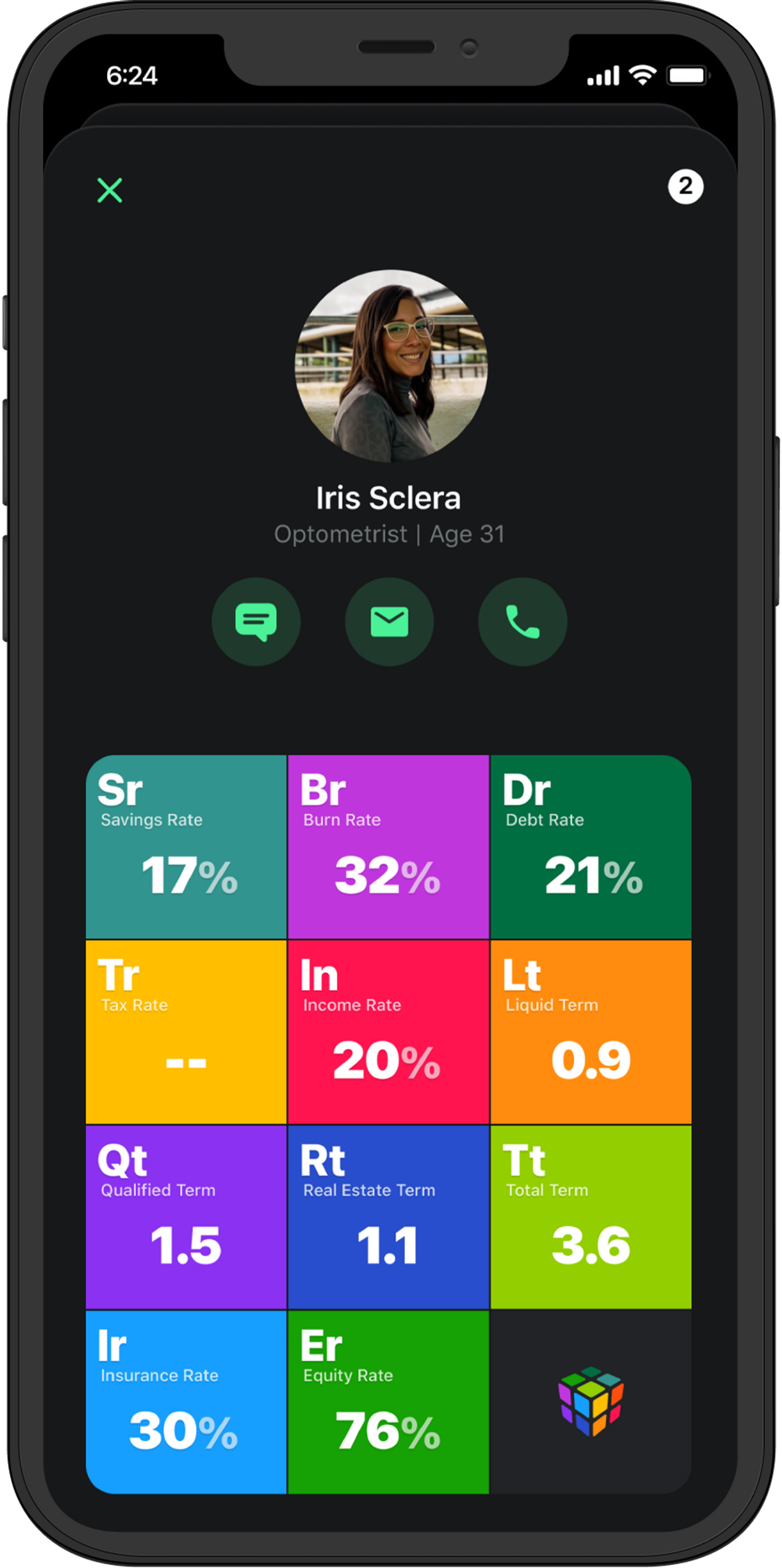

Don’t feel ready to work with an advisor? Do you want a sample experience of how we help? A Financial Snapshot allows us to get to know you and provide some general feedback on your situation at no cost to you!

Confidence in your financial plan is crucial, but what do you do if you don’t

Life is full of financial obligations that ebb and flow throughout the year. From holiday

As financial planners, we look at specific events throughout a client’s lifetime to implement various

We’ve had a long stretch of time where student loan payments have been paused. Are

Have you pushed off electronic delivery of your monthly statements? Is your “filing” system overflowing

“In every life we have some trouble, but when you worry you make it double.

610 Esther St, Suite 100,

Vancouver, WA 98660

360.254.2585

811 SW 6th Avenue, Suite 1000,

Portland, OR 97204

503.248.9064

1730 N. Northlake Way, Suite 3301

Seattle, WA 98103

206-324-1950

This site is for informational purposes only and is not an offer to sell or a solicitation of an offer to buy any securities or investment advisory services which may be referenced herein. We may only offer securities in states in which we have been properly registered or are exempt from registration. Therefore some of the services mentioned may not be available in your state, and if not, the information is not intended for you.

Before joining First Pacific Financial in 2018, Harrison worked in the banking industry for six years.

He came to us from the Beehive State of Utah, where he graduated with a Financial Planning and Business Management degree from Utah Valley University. His passion for people and crunching numbers made a career in financial planning a perfect fit.

When it comes to his work, Harrison has a passion for helping those in the nursing industry. All his life, nurses have surrounded him. Because of that, he’s learned to appreciate their work of compassionate care. The recent pandemic has only accentuated that gratitude.

Harrison understands that the nursing industry is demanding and, at times, high-risk. For nurses, thoughtful planning to provide the best possible financial future for their families is crucial. His focus is to provide his clients with a well-crafted investment strategy to meet the financial goals that are most important to them.

When he’s not helping his clients, Harrison enjoys spending time with his wife and three young boys. You’ll usually find them at the local park or watching the latest Disney movie.

Please enter your name and email below to download your free copy of Financial Planning for Medical Professionals.

Please enter your name and email below to download your free copy of Important Numbers 2025.

Please enter your name and email below to download your free copy of our Family Expansion Checklist.

Please enter your name and email below to download your free copy of our Home Buying Checklist.

It was on the basketball court at Western Washington University that Todd learned the importance of leadership and hard work. He knows this can carry an organization to the highest levels and lift individuals toward accomplishments that cannot be achieved alone or without the team.

Todd has been recognized by the investment advisor community for turning First Pacific Financial into a next-generation firm focused on company culture, financial planning, consistent investment philosophy, and technology. His effort and innovation is landing him speaking engagements on panels at national conferences.

After nearly 20 years working with First Pacific Financial’s amazing clients, he now finds much of his time spent leading as both Chief Executive and Investment Officer. Todd’s primary goal is to consistently make an impact on each employee and every client. He believes that the power of money and compounding wealth provides an opportunity for all of us to express our values in the world, helping to make it a better place. By helping individuals and families find their most amazing financial lives, we can change the world for a better tomorrow.

When not leading our team, Todd is active in one of his many hobbies. His interests include refurbishing and using his Vanagon camper van, biking, restoring classic arcades, reading, gardening and more. He and his wife Jessy live in Vancouver, Washington with their daughter Lily and son Taj.

Taryn comes to First Pacific Financial with over 18 years of experience in the media research field. She has a bachelor’s degree in psychology from Portland State University and has always had a passion for working with people. During her career, she has served in senior leadership roles as well as supporting clients directly as an account manager. She has an unparalleled ability to foster a culture seldom seen in firms of our size. Taryn understands that learning is a lifelong adventure, and she continuously pursues personal and professional development. By sharing knowledge, inspiring others, and creating an environment of teamwork, Taryn aspires to ignite both individual and corporate success.

We can all agree that there is never enough time in the day, with the time Taryn has she spends with family and friends. Taryn is a Portland Thorns fan (RCTID!), avid reader, enthusiastic coffee drinker, sideline soccer cheerleader for her two kids, and will not turn down the opportunity for an impromptu dance party (in or out of the office).

Brandon’s interest in financial services stems from the vast opportunity for research and analysis in the industry. From quantifying portfolio probabilities to measuring the risk inherent in the capital markets, he thrives on studying challenging concepts.

Brandon began his career in the financial services industry in 2002 working with defined contribution plans, and later defined benefit plans for a local retirement plan administrator. He kept a devotion to investing by studying, reading, and learning as a primary leisure activity. He joined First Pacific in 2016, strengthening our firm’s Investment Committee.

Brandon and his wife embark on adventures traveling around the Pacific Northwest with their daughter, trying new restaurants, and eating gourmet food.

A recent transplant to the Pacific Northwest, Chad grew up in the Midwest and living there most of his life he developed a keen ability to dodge tornadoes, floods, heat waves and snowstorms. Sadly very little of that transfers to his new home where he does everything he can to get outdoors and enjoy the beauty and wonder of the region with his wife and two dogs. He is unparalleled in his love for animals of all types and can’t go five minutes without sharing photos of his fur babies.

His technical background includes a decade with the Department of Defense where he assisted the US military with a wide array of mechanical and technical jobs that eventually ended when he left to pursue his passion in web and application development. Working as a project manager he was an ideal choice to take on the role of Director of Technology at First Pacific Financial and is constantly looking for ways to better the firm and our clients through secure practices and IT solutions.