“In every life we have some trouble, but when you worry you make it double. Don’t worry, be happy”

– Bobby McFerrin

Technology allows us to have access to information whenever we want it, but is that a good thing? Clients often ask us how often they should look at their portfolio balance. We have a handful of clients who look at it every single day as soon as the stock exchange closes. Is this healthy? Do the daily check-ups make you a better investor? Probably more important than anything: Does it help you be happy?

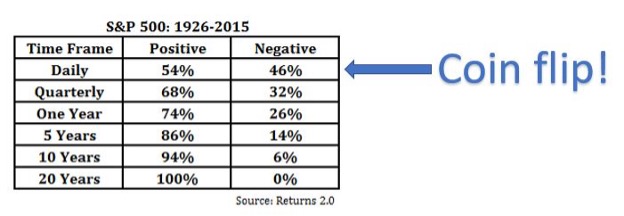

The data shows that this is unhealthy, it makes you a worse investor, and it’s practically a coin flip if you’ll be happy because your portfolio went up or down.

As professional investment managers, we aim to remove emotions and behavioral biases from the decisions we make. As an example, we don’t rebalance portfolios based on when it “feels” right or when we reach some magical price of the Dow Jones Industrial Average. We rebalance when a client’s portfolio is out of balance. We monitor this daily and measure it by allowing an investment to increase or decrease within a tolerance range.

Despite our daily monitoring, there are usually only a few opportunities throughout a normal year to rebalance. We just don’t want to miss the opportunity when it presents itself to sell high and buy low. As the chart shows, the longer you can go without checking your portfolio, the greater probability you’ll find a positive result. This doesn’t suggest that you have to wait 20 years, but you would certainly decrease your odds of making a poor investment decision!

If you “feel” happy when your portfolio is up, and sad or disappointed when it’s down, your best cure is to stop looking every day. In a 60% stock and 40% bond portfolio, the odds of being positive (green) or negative (red) are similar to the chart above. Perhaps the key to happiness is deactivating online access and waiting for that annual statement.

Source: https://theirrelevantinvestor.com/2019/04/11/how-to-improve-your-risk-adjusted-returns/